What Is The Pennsylvania Sales Tax On a Vehicle Purchase eTags

Utah’s New Tax Bill By Common Consent, a Mormon Blog

Some states impose an excise tax on the sale of new cars, but the tax rate for Delaware is lower than that of those set by other states. Car taxes in Delaware range around $20 for regular vehicles with four wheels and a weight of fewer than 6,000 pounds. Delaware has a gas tax of 12 cents per gallon.

Delaware Title Transfer How To Sell a Car in Delaware Quick

Our free online Delaware sales tax calculator calculates exact sales tax by state, county, city, or ZIP code. Tax-Rates.org — The 2023-2024 Tax Resource. Start filing your tax return now : TAX DAY IS APRIL 15th - There are 128 days left until taxes are due. Try our FREE income tax calculator

Delaware Motor Vehicle Bill of Sale Form Template GeneEvaroJr

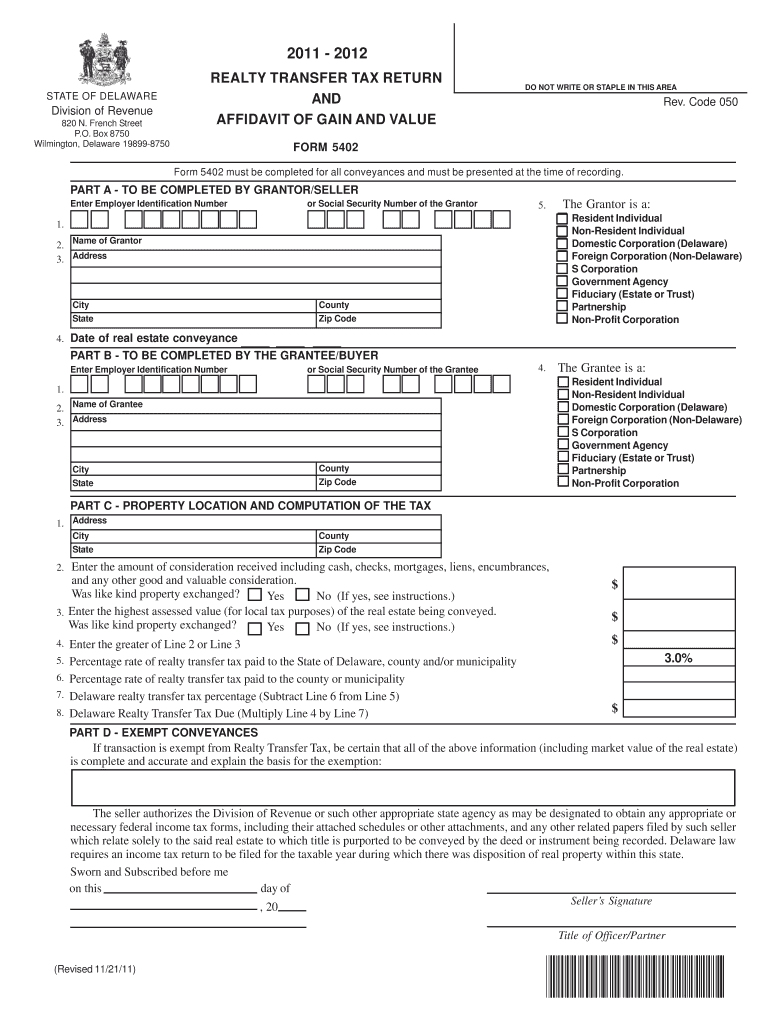

If a vehicle, which has been titled in another state, is being titled in Delaware and there has been no sales tax or similar titling tax paid on the vehicle in the other state within the last 90 days, use the current N.A.D.A Official Used Car Guide OR the N.A.D.A. Appraisal Guide for OLDER Vehicles (whichever guide the vehicle is listed in) to.

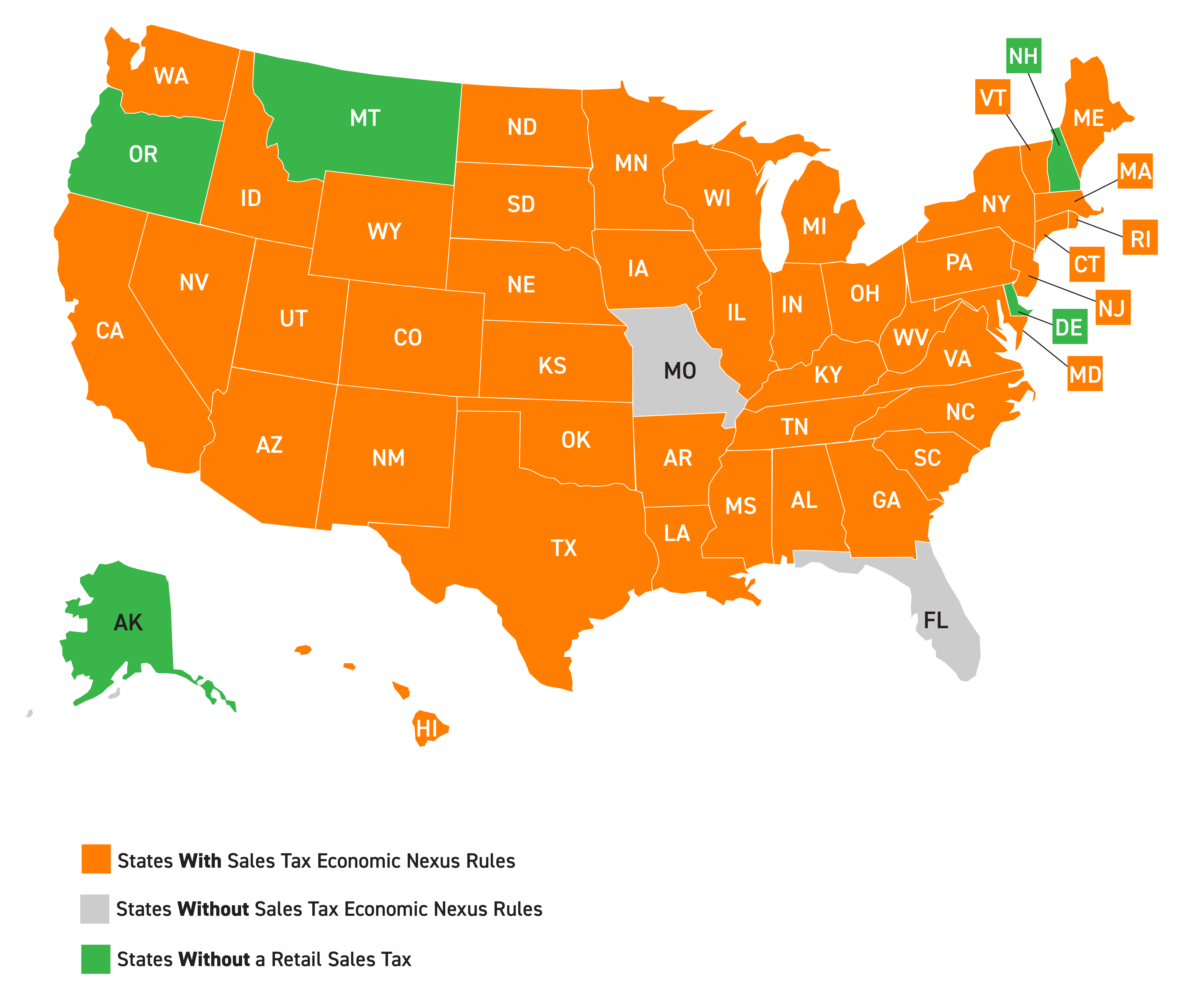

Should States Charge Sales Tax To Online Business?

Number of Titles. Number of Extra Stickers. Switch Tag. Duplicate Tag. Late Titling. Service Fee. Antique Fee. New Tag Background Image. Dealer's Portal, DelDOT, Delaware Department of Transportation, Delaware.

Delaware Tax Sales Redeemable Tax Deeds YouTube

United States vehicle sales tax varies by state, and often by counties, cities, municipalities, and localities within each state.. Delaware: 4.25% "Motor Vehicle Document Fee" Fee Calculator: District of Columbia "Excise Tax" varies by weight & mpg 0% for electric vehicles: Tax Calculator. fuel economy .gov. D.C. Tax Facts. 86T:

Delaware is a shopping shelter with no sales tax! Tax, Sales tax

Spread the loveIntroduction Delaware, known as the First State, offers an attractive buying proposition for anyone looking to purchase a car. In contrast to many other US states, Delaware does not levy sales tax on cars, making it an attractive spot for vehicle purchases. This article provides an in-depth look at the absence of sales tax on cars in Delaware and its benefits to people looking.

Tax Tips A Complete Sales Tax Guide

The credit/refund vehicle must be a Delaware titled vehicle, and the name on the title must be the same as at least one of the applicant(s) who is applying for the title on the new vehicle. When the sale of the credit/refund vehicle occurs after titling a new vehicle, the Document Fee Credit/Refund Application (MV347) must be received by the.

Sales taxes in the United States Wikipedia

Licensing and Tax Information. Tax Tips for Motor Vehicle Dealers Conducting Business in Delaware. Things You Should Know. Definition 30, Del. C., Ch. 23, 29, 30 and 43. Motor vehicle dealer includes every person in the business of buying, selling or trading new or used motor vehicles, trailers, truck trailers or motorcycles.

Gross McGinley Online Sales Subject to Sales Tax

Georgetown: Division of Revenue, 20653 Dupont Blvd., Suite 2, Georgetown, DE 19947. The phone number is (302) 856-5358. You can also email the Delaware Division of Revenue at rev_ [email protected] or call the main number at (302) 577-8662.

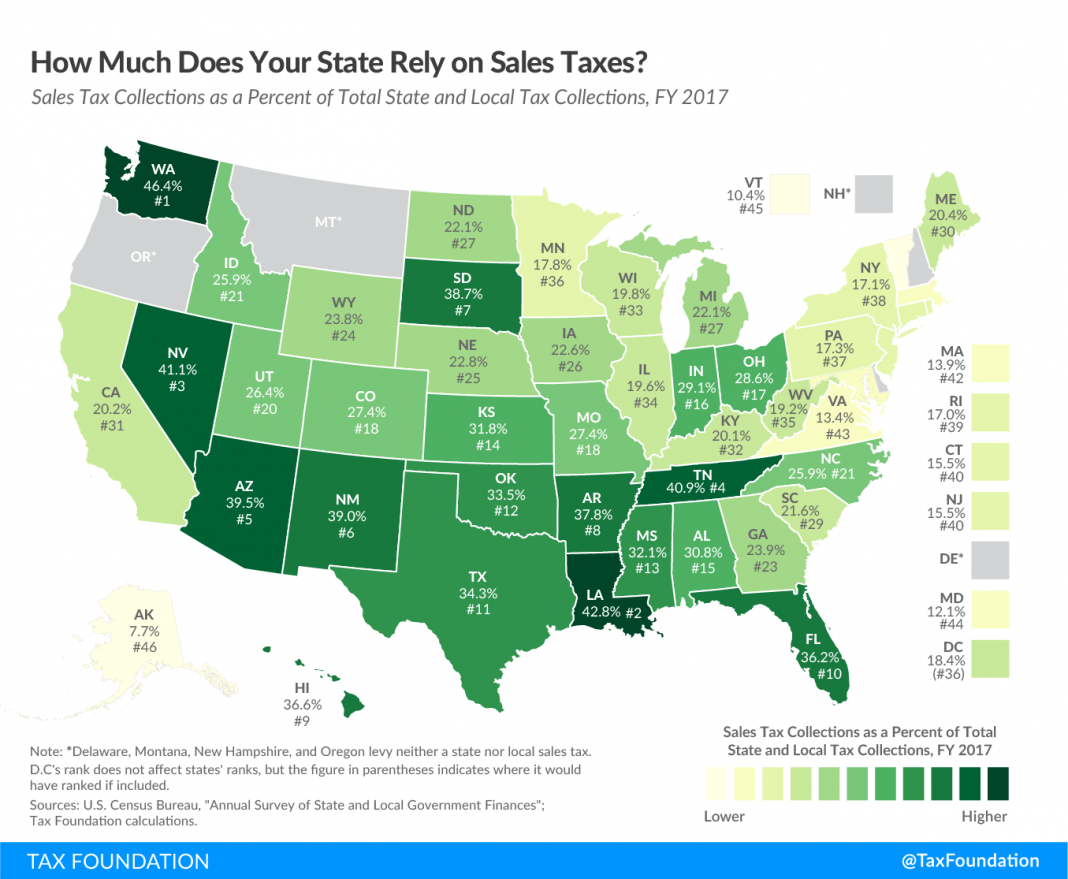

State & Local Sales Tax Rates 2023 Sales Tax Rates Tax Foundation

0.00%. 2023 Delaware state sales tax. Exact tax amount may vary for different items. The Delaware state sales tax rate is 0%, and the average DE sales tax after local surtaxes is 0% . Delaware has no sales tax, and does not allow cities or counties to assess any type of sales tax. Businesses are, taxed on their gross receipts as an alternative.

Delaware state sales tax and rates Sales tax, Delaware state, Delaware

The fee for passenger vehicle registration is $40 per year, which includes the cost of your standard license plate. A Delaware vanity plate is $40 in addition to the $40 registration fee, and you can only apply online through the Delaware DMV website. In Delaware, vehicles are required to have only a rear license plate.

TAX FOUNDATION To What Extent Does Your State Rely on Sales Taxes

Delaware car sales tax rate. Delaware is one of a few states that has no state sales tax. Other states with no car sales tax include: Of the three counties in Delaware, the only one that has a local sales tax is Sussex County, at a rate of 6%. Delaware does charge a documentation fee of 4.25 % on all motor vehicle sales.

SaaS Sales Tax for the US A Complete Breakdown

When paying for the vehicle, you'll also be charged a 3.75 percent document fee based on the vehicle's overall cost. If your car or truck is considered new, you'll also pay a $25 title fee. If you.

OutofState Sales Tax Compliance is a New Fact of Life for Small

Delaware's lack of a sales tax for cars means that the state misses out on potential revenue that could be used to fund public services and programs. This can be a disadvantage for residents of the state. FAQs 1. Do I have to pay sales tax on a car I buy in Delaware? No, Delaware does not have a sales tax for cars. 2.

Delaware Form 5402 Instructions Fill Online, Printable, Fillable

Solved: We live in Delaware, and we bought a car in 2018. When we go to DMV, other than the $80 registration fee, we also paid a documentation fee of $1147,. What you are paying is akin to a sales tax or impact fee in other states which is not deductible. View solution in original post July 18, 2019 9:30 AM. 0 6 4,085 Reply. Bookmark Icon.

Sales tax creates more unnecessary pain than value added tax

Delaware law allows out-of-state vehicle owners a credit on a sales tax, transfer tax or some similar levy paid to another state on the purchase of a vehicle within 90 days prior to registering the vehicle in Delaware. The vehicle must have been titled/registered in the other state within 90 days prior to registering the vehicle in Delaware.